can i deduct tax preparation fees in 2020

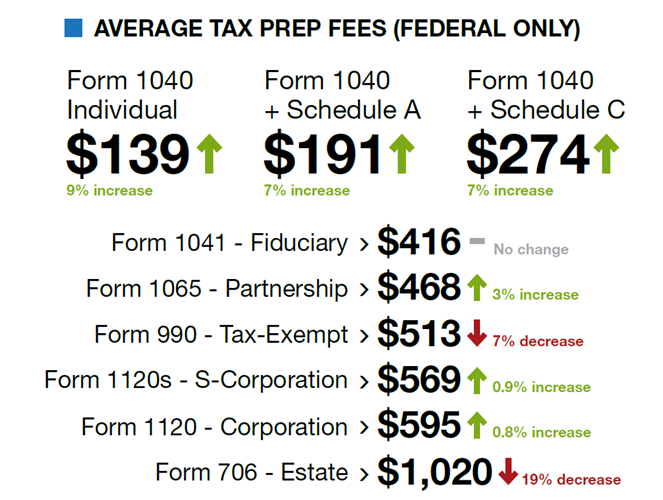

Deducting Tax Preparation Fees on Personal Taxes. Depending on the complexity of your business tax preparation fees can range from 400 to 4000 and beyond.

Tax Strategies For Parents Of Kids With Special Needs The Autism Community In Action Taca

However the law is only valid from 2018 to 2025.

. Prior to 2018 taxpayers who werent self-employed were allowed to claim tax prep. Tax Preparation Fee Schedule 2020 Rivanna Wood Financial Tax Services from. Note that only those who itemize their deductions are.

They also include any fee you paid for electronic filing of your return. The mileage tax deduction rules generally allow you to claim 0575 per mile in. The fee from the accountantpreparer.

Cost of tax-prep software programs Fees for e-filing including credit card fees etc. You can go all the way to the end of the TurboTax process without paying to see what the final result would be. You can deduct your tax preparation fees whether you pay to prepare your taxes once a year or pay quarterly taxes.

The only thing required is that you fall in one of the categories of workers. Generally tax prep fees are no longer deductible for most people. However you can get preparation fees deductions if you operate your own business.

Tax Preparation Fee Schedule 2020 Rivanna Wood Financial Tax Services from. While tax preparation fees cant be deducted for personal taxes they are considered an ordinary and necessary expense for business owners. Those who are self-employed can still claim a tax deduction for the fees paid to prepare tax returns.

These fees include the cost of tax. Unless youre self-employed tax preparation fees are no longer deductible in tax years 2018 through 2025 due to the Tax Cuts and Jobs Act TCJA. If youre an employee and you receive a W-2 in order to prepare your taxes the short answer is that you are no longer able to deduct your.

You can deduct your tax preparation fees whether you pay to prepare your taxes once a year. You can find out more. Most advisory tax preparation and similar fees are categorized as miscellaneous itemized deductions.

Agree with the try both one year to compare. Tax preparation fees on the return for the year in which you pay them are a miscellaneous itemized deduction and can no longer be deducted. And the answer is no not for a few.

Self-employed taxpayers can still write off their tax prep fees as a business expense. Accounting fees and the cost of tax prep software are only tax-deductible in a few situations. These fees include the cost of tax preparation software programs and tax publications.

For example on your 2021 tax return you deduct the fees you paid to prepare your 2020 taxes. Pre-TCJA for an individual these fees were deductible to the extent they. Are tax preparer fees deductible in 2020.

Fortunately these costs are usually deductible in your Schedule C. I did this during one particularly. For example on your 2021 tax return you deduct the fees you paid to prepare your 2020 taxes.

People often ask Can I still deduct my tax preparation fees. This means that if you are self. For most Canadian taxpayers the answer unfortunately is no.

This is a one minute moment. Congress will need to.

Tax Deductions Lower Taxes And Tax Liability Higher Refund

Can You Deduct Your Tax Preparation Fees Cpa News

Publication 530 2021 Tax Information For Homeowners Internal Revenue Service

How Much Are Average Tax Preparation Fees

Tax Planning Strategies Tips Steps Resources For Planning Maryville Online

H R Block Review 2022 Pros And Cons

Tax Deduction For Legal Fees Is Legal Fees Tax Deductible For Business

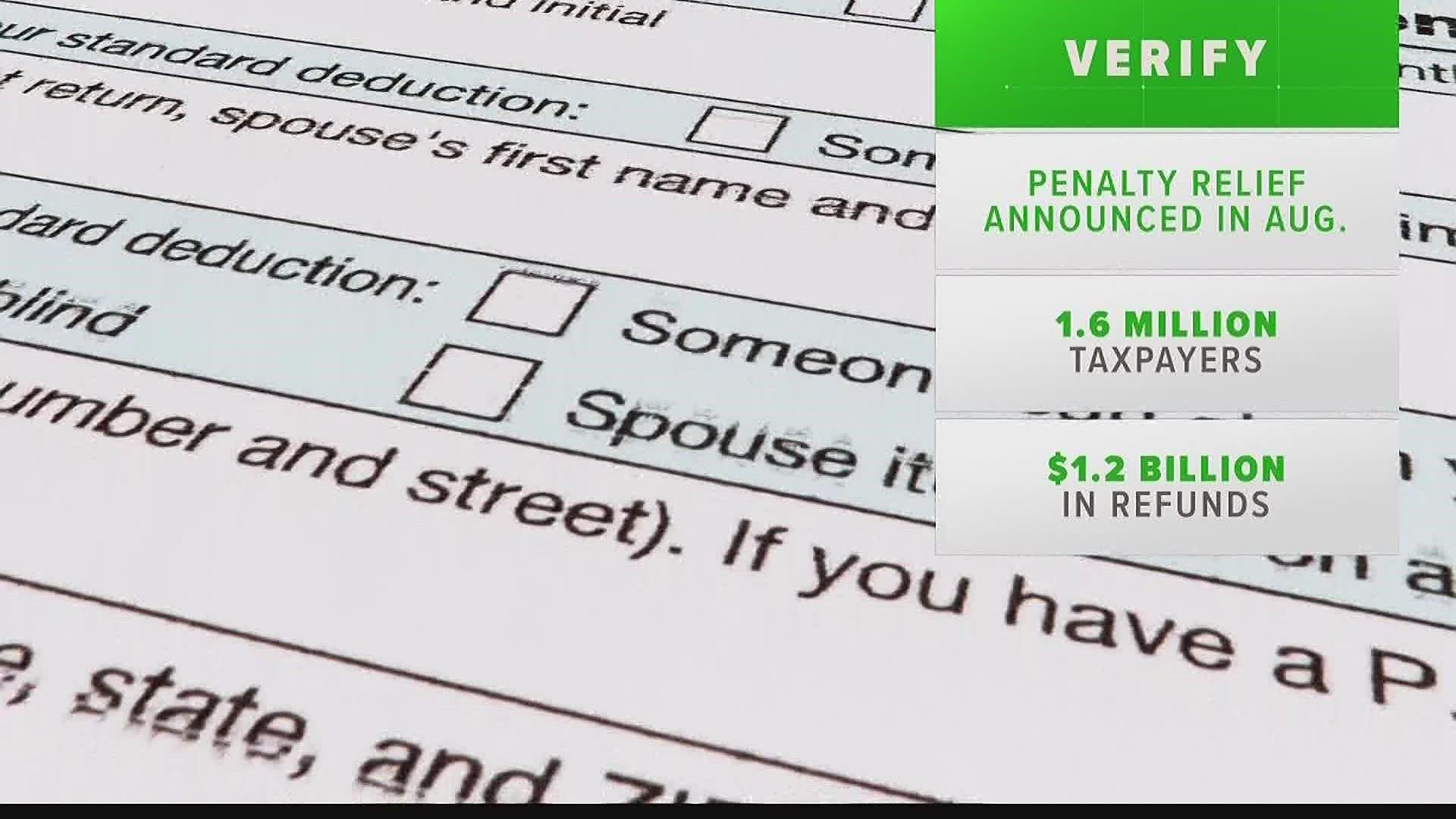

Is The Irs Forgiving Some Late Filing Fees Because Of The Pandemic 11alive Com

The Ultimate Guide To Tax Deductions For The Self Employed Article

Are Tax Preparation Fees Deductible Accounting Tax Advisers Cpas Ltd

Deluxe Online Tax Filing E File Tax Prep H R Block

Are Medical Expenses Tax Deductible

Can The Student Loan Interest Deduction Help You Citizens

Are Estate Planning Legal Fees Deductible From Your Taxes

Schedule A Form 1040 A Guide To The Itemized Deduction Bench Accounting

How To Deduct Charitable Donations On Your 2020 Taxes Nextadvisor With Time

9 Best Tips To Prepare For Tax Filing Season Bankrate

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Tax Deductions For Rideshare Uber And Lyft Drivers And Food Couriers Get It Back